r&d tax credit calculation example

As pointed out in other comments in Y Combinators forum The real issue with the R. Identify and calculate the average QREs for the prior three years.

Remember to check your RD tax credit calculation to ensure you are using the method most advantageous to your business.

. This credit appears in the Internal Revenue Code section 41 and is. There are two standard methods of calculating. Use our simple calculator to see if you.

RD tax credits one size does not fit all. Multiply the fixed-base percentage by the average annual gross receipts from the previous four years to determine the base amount. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA.

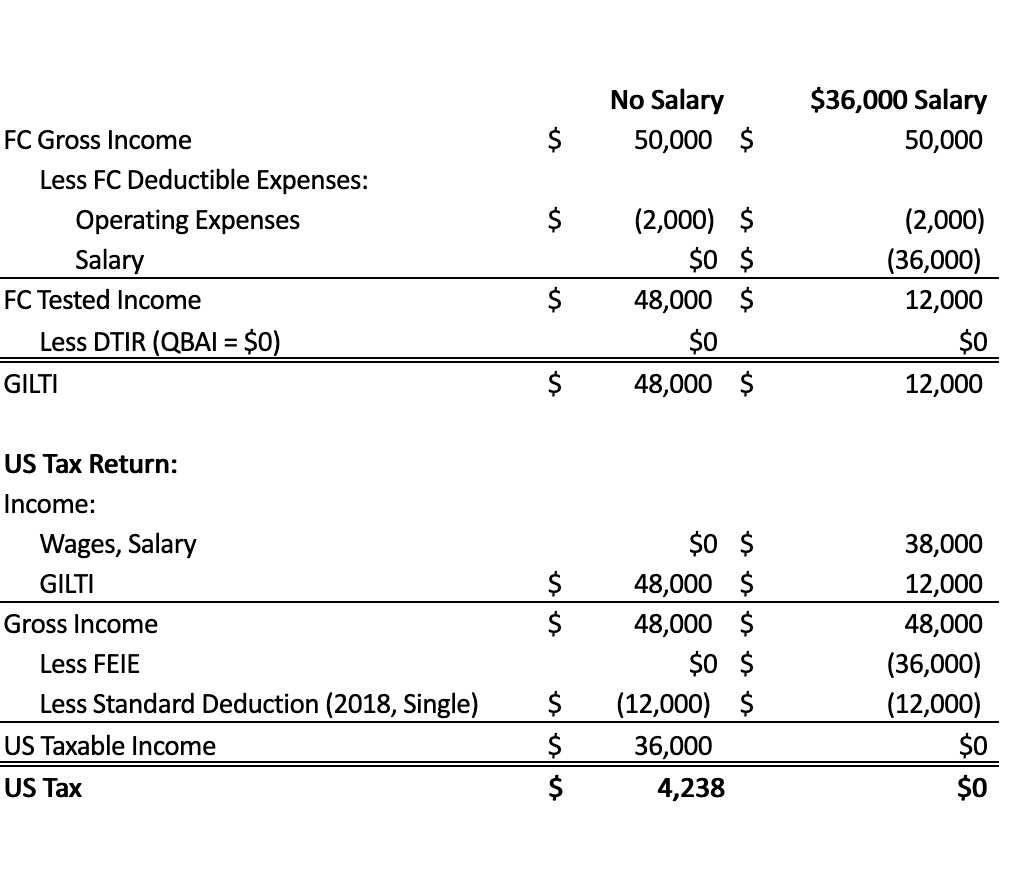

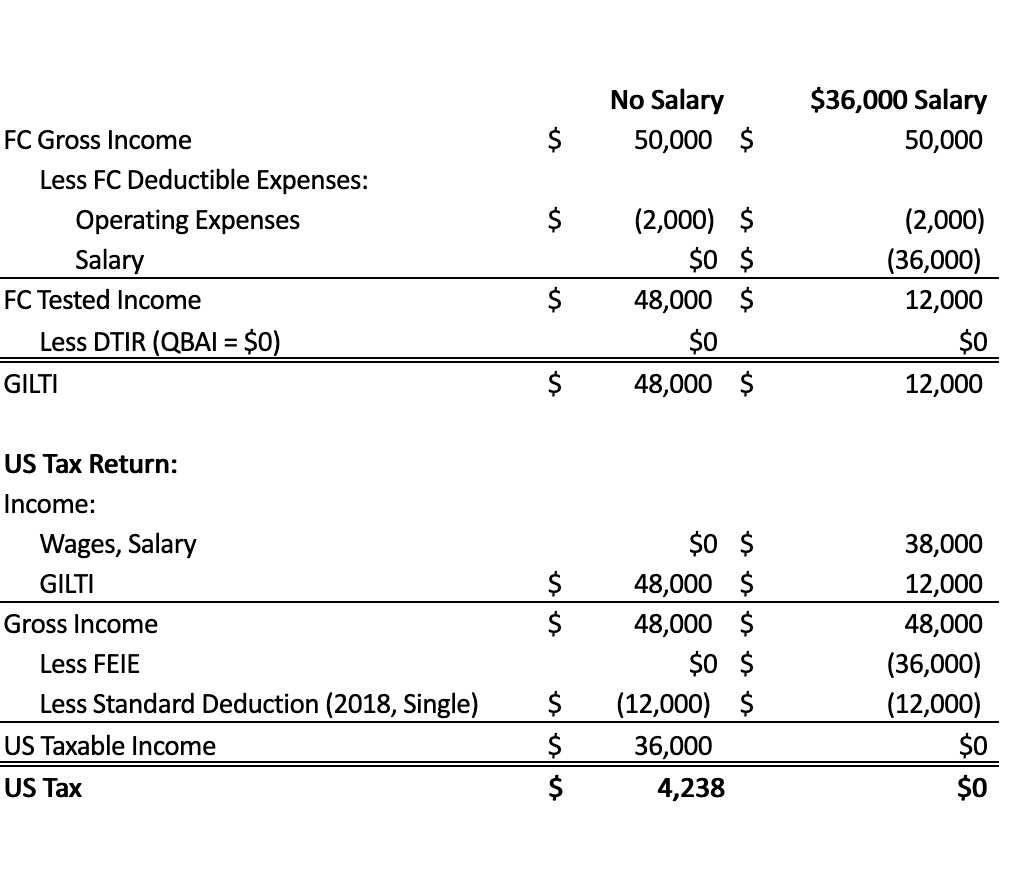

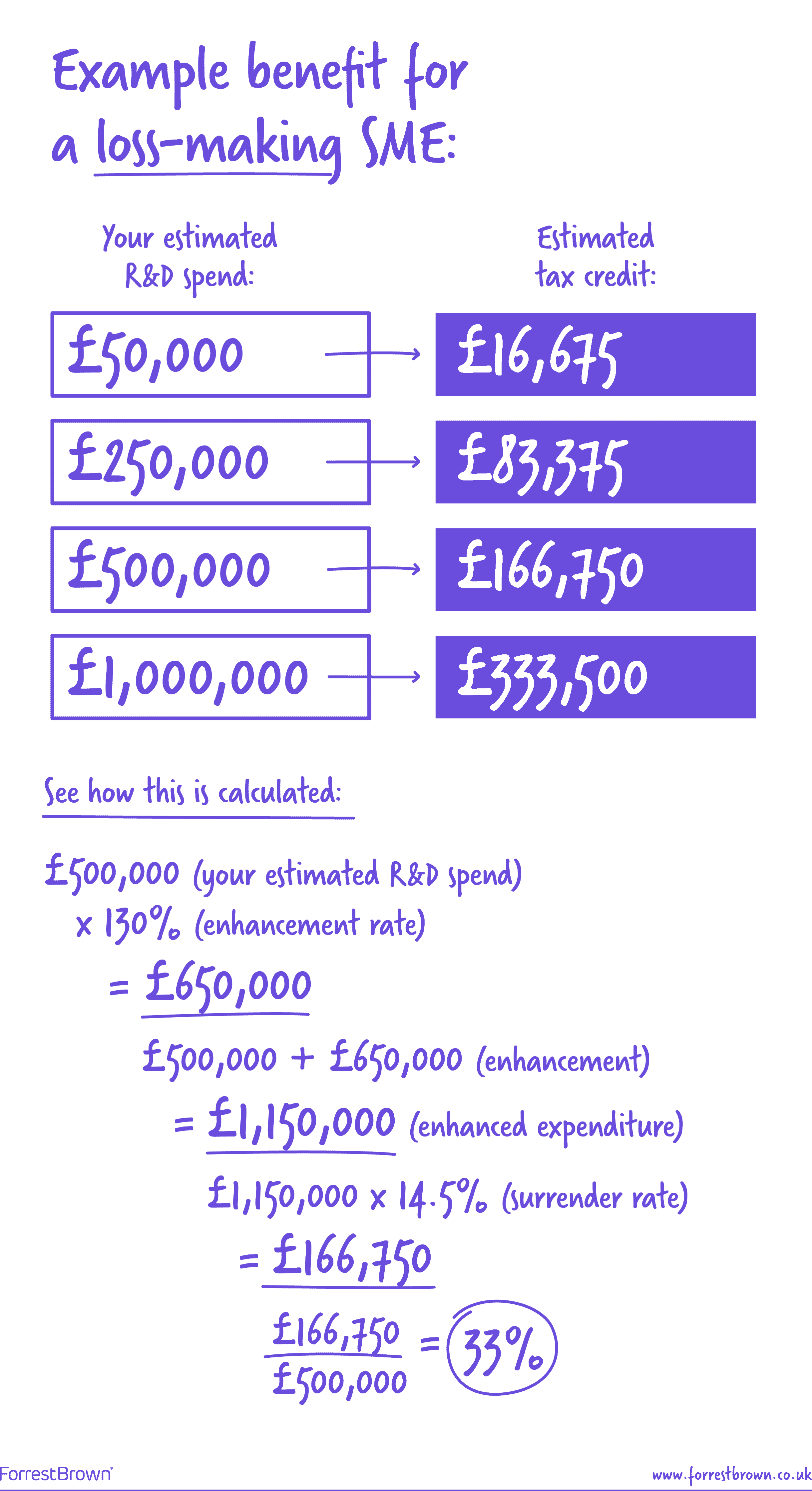

Profitable SME companies will benefit on average by a saving of 25. Estimate Your Savings Now. Example 1 is optimal because the.

RD Tax Credit Calculation Examples Profitable SMEs. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out. Corporation Tax before RD tax credit claim.

If in 2022 A to Z Construction had qualified. Ad Use The RD Tax Credit to Offset Payroll or Income Taxes. Ad Use The RD Tax Credit to Offset Payroll or Income Taxes.

Subtract half of the three-year average Step 2 from current year. Claiming the RD Tax Credit. Fifty percent of that average would be 24167.

For example RD tax credits have the potential to offset income tax which can reduce a companys tax burden in the years qualified activities occur. Find Out More With Our Free RD Tax Credit Calculator. When subtracting it from the original corporation tax before the claim the total saving for this.

The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. If the company spent 100000 on. Take the greater of the base amount calculated or 50 of.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. 31 Federal RD Tax Credit - Description As of July 1996 the RD tax credit is generally computed based on the following formula. When you qualify as an SME in terms of the SME scheme but youre making a loss instead of a profit the RD Tax Credit Calculation is the same as the procedure set out above.

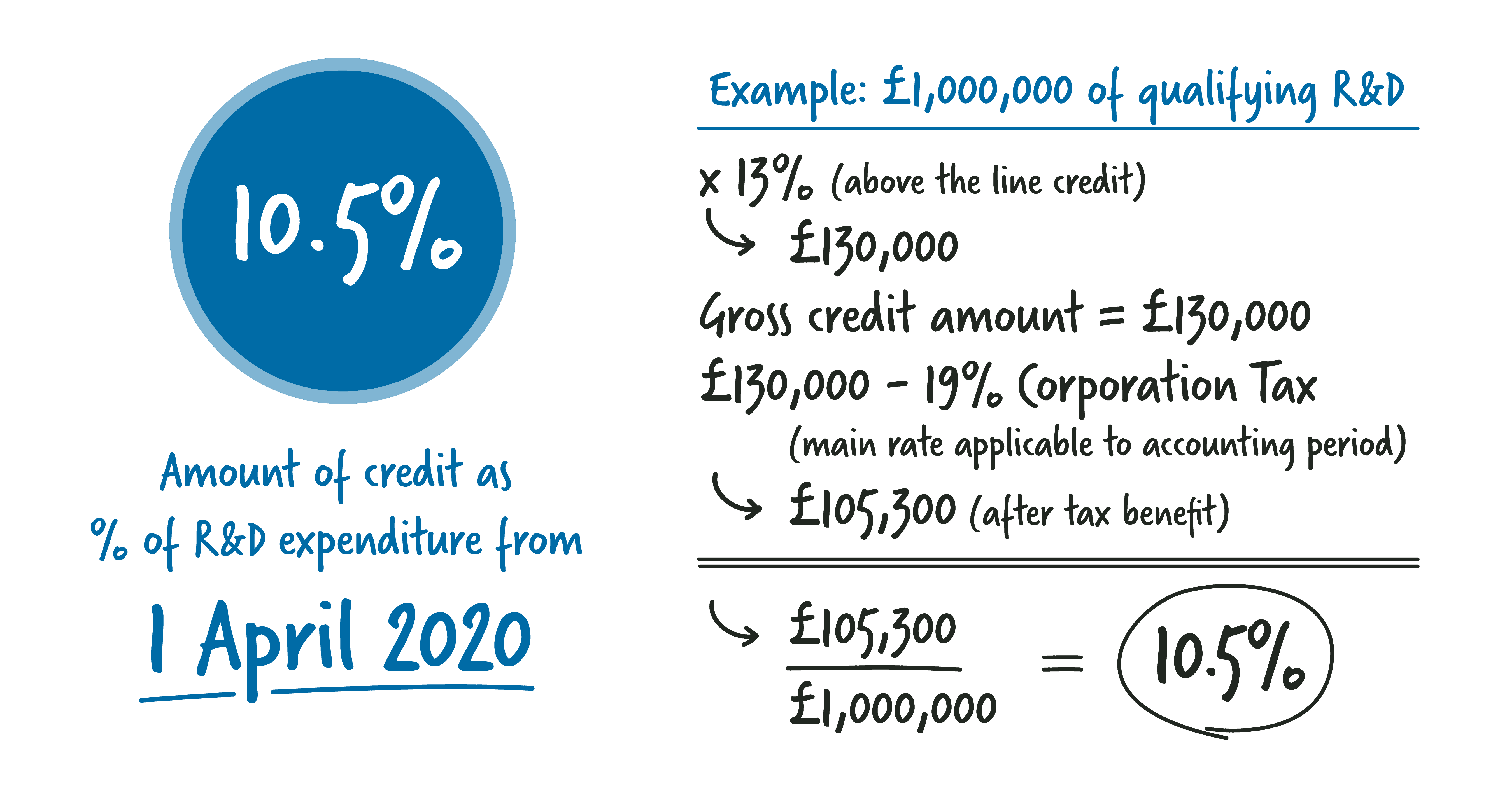

100000 x 130 130000 uplift 400000 130000 270000 revised profit 270 000 x 19 51300. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction.

Find Out More With Our Free RD Tax Credit Calculator. One of the hard issues to understand about RD Tax Credits is that the pre RD tax position influences the amount of the payable tax credit. A to Z Constructions average QREs for the past three years would be 48333.

Estimate Your Savings Now. To get specific you calculate and report the credit on IRS form 6765 and submit it with your companys tax return. Regular research creditThe RRC is an incremental credit that equals.

Multiply average QREs for that three year period by 50. 20 x Qualified Research Expenses less Base Amount 20.

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

Getting To Know Gilti A Guide For American Expat Entrepreneurs

R D Tax Credit Calculation Examples Mpa

State R D Tax Credits Are You Missing Out Wipfli

Gilti Detailed Calculation Example

R D Tax Credit Calculation Methods Adp

Annual Percentage Rate Apr Formula And Calculator

R D Tax Credit Rates For Sme Scheme Forrestbrown

Gilti Detailed Calculation Example

Grade 6 Lab Report Template 2 Templates Example Templates Example Lab Report Template Report Template Lab Report

Gilti Detailed Calculation Example

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)